Is Xiaomi Mi Credit a good player in the credit industry?

Xiaomi MI Credit, which provides credit services to its clients, is India’s most popular phone brand. You may apply for a loan utilizing the MI Credit quick lending service if you run the MIUI or Xiaomi operating system.

If a Xiaomi user seeks a loan, the platform will match them with the most acceptable financial option. This app can apply for loans ranging from Rs 1,000 to Rs 1 lakh based on their credit score and other factors.

Customers who take out this loan may pay it back in monthly installments with a low-interest rate. Customers get credit from Mi, but the business acts as a go-between, linking them with service providers. In May of last year, Xiaomi debuted Mi Credit in a limited capacity.

KrazyBee, a Bengaluru-based company, has collaborated with the firm. Xiaomi has always been known in the fields or applications and services, but it is now firmly entrenched in the financial sector with the Mi Credit service.

Mi Credit had been available to all Android users since its launch a few months ago. Using Mi Credit’s service, anyone may receive a personal loan in 5 minutes. Mi Credit is not the same as Mi Pay for those who are confused.

Like Paytm and PhonePe, Xiaomi’s Mi Pay app supports UPI-based money transfers. Mi Credit has something unique about it that has nothing to do with transactions. Lenders may use Mi Credit to offer personal loans to customers fast and without a significant wait. It’s a brilliant concept.

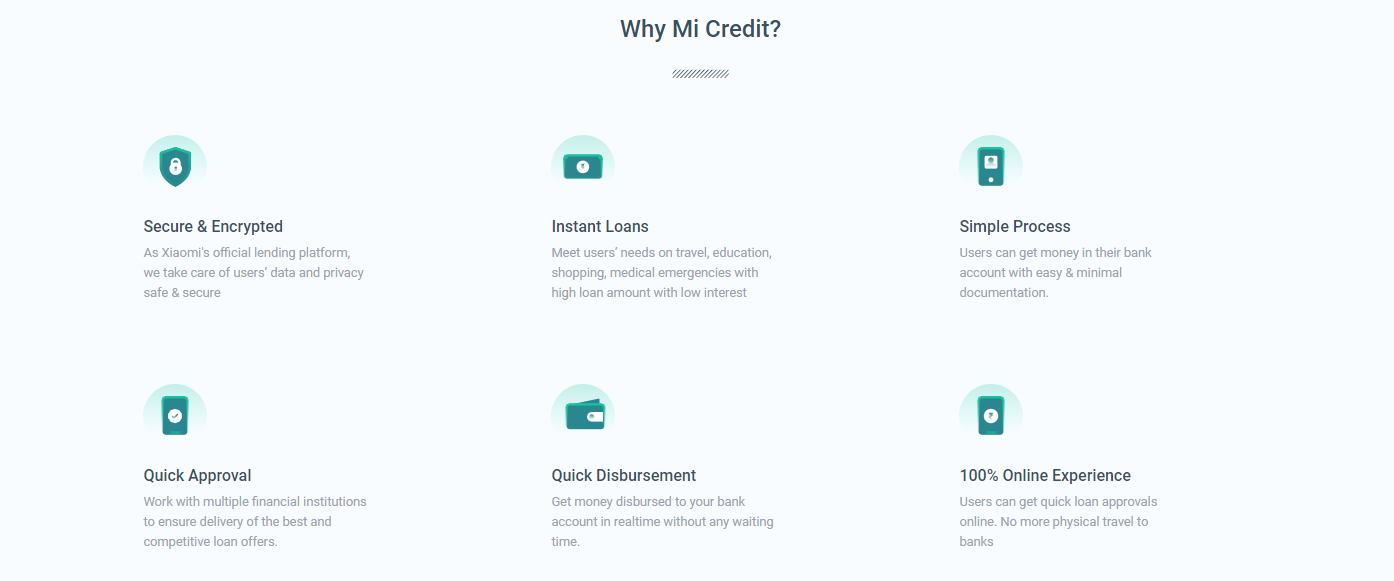

Xiaomi has also made a concerted effort to make the service as user-friendly as possible for its consumers. Individual loans may be obtained quickly and easily with Mi Credit’s help. Users may apply for a loan quickly and receive prompt approvals. Xiaomi also promises a reduced interest rate.

While Mi Credit was in beta testing in the year 2019, this year it is well known. Xiaomi claims that over 28 crore loans have been successfully distributed. Furthermore, 20% of consumers desired loans of up to Rs 1 lakh.

Mi Credit, according to the company, works with all central Indian banks. Xiaomi has partnered with Aditya Birla Finance Limited, Money View, Early Salary, Credit Vidya, and Zest Money to provide loans.

Xiaomi Mi Credit allows you to borrow money from friends and family securely and efficiently as a personal lending service. Customers who use the MIUI operating system may get it for free from the Xiaomi website. Borrowing in real-time is feasible up to a lakh rupees.

It varies from 1.3 to 2.5 percent every month. Mi Credit’s loan partners include Aditya Birla Capital Personal Finance, Money View, EarlySalary, CreditVidya, and ZestMoney. Company officials claim the loan application procedure should take no longer than five minutes.

Xiaomi has also said that the entire system is done digitally, which is a great thing. It’s free to check your credit score on the app. The software is available for free download from the Google Play Store. Your Mi account or phone number must then be used as the registration method.

You must provide your KYC papers, which include identification and residency, and will be verified online. Following that, you’ll need to provide your bank account information to make transactions run more efficiently. Anyone above the age of 18 can apply for a loan of up to Rs 1 lakh.

EMIs can be used to repay the loans over a period of 91 days to three years. Mi Credit’s interest rates begin at 1.35 percent per month, which is relatively affordable.

Benefits of a Mi Credit Loan

- Mi Credit loans have a painless and straightforward application process.

- After you’ve satisfied the conditions, your bank account will be charged.

- Mi Credit may provide you with a loan with an interest rate as low as 1.8 percent per month!

- Mi Credit has you covered when it comes to the security of your personal information and loan credentials.

Mi Credit Loan’s main characteristics An Experian credit report: The Mi Credit app allows you to check your credit history and Experian data worth Rs. 1,200 for free. With only a few key facts, you may immediately analyze your bureau report.

You’ll also get advice on how to improve your credit score if you ever need a loan. The following are some of the product’s benefits: Xiaomi’s authorized personal loan application uses cutting-edge security technologies to protect your details.

Obtaining the most favorable loan offer You might borrow up to Rs 2,000,000 at an initial yearly interest rate of 1.35 percent. Taking out a loan is a simple procedure: Documentation that is simple to understand

Therefore, we can say that we have so many positive aspects and good ratings in India; this application is a secured and a boon to financial credit sectors, which provide hassle-free instant loans to its trusted customers.