How one man built Mu Sigma from his $200,00 Savings

Introduction – Mu Sigma is an Indian decision sciences firm that primarily offers data analytics services. The firm’s name is derived from the statistical terms “Mu (μ)” and “Sigma (σ)” which symbolize the mean and the standard deviation, respectively, of a probability distribution.

Mu Sigma is headquartered in Chicago, Illinois and has a global delivery center in Bangalore. Mu Sigma offers data analytics services and develops decision support system tools and software for Fortune 500 organizations.

It offers marketing analytics, such as marketing measurement, product/customer segmentation and profiling, prospecting, RFM analysis, purchase likelihood analysis, cross-sell/up-sell analysis, loyalty/customer lifetime modeling, churn analysis/retention modeling, brand/customer equity analysis, customer satisfaction analysis, marketing mix modeling and optimization, and others.

Mu Sigma also provides risk analytics, such as predictive modeling of claims, credit scoring, fraud detection and prediction, foreclosure prediction, rating structures, loss ratio analysis, risk based pricing, statistical analysis for FDA trials, elasticity/sensitivity/scenario/what if analysis, collection and recovery analytics, extreme event modeling, and others.

Moreover, it offers supply chain analytics, which include trend plotting, demand/manpower forecasting, location allocation decision making, inventory management, sourcing/capacity/materials/transport optimization, stock replenishment analysis, due date quoting, expediting optimization, logistics and distribution analysis, vendor managed inventory systems, and others.

Mu Sigma serves companies operating in airline, hospitality and entertainment, pharmaceuticals and healthcare, BFSI, CPG, retail, technology, and telecom industries. Dhiraj Rajaram founded it in 2004.

Early Days – Mu Sigma was founded by Dhiraj Rajaram, a former strategy consultant at Booz Allen Hamilton and PricewaterhouseCoopers, in 2004. It was founded in 2005 with the vision of helping organizations institutionalize decision-making using data analytics by providing analytical capabilities on a real-time basis.

Prior to this, Dhiraj worked as a consultant with Booz Allen Hamilton and Pricewaterhouse Coopers in the US. While working as a consultant, he noticed that well-paying analytics positions in organizations remained open for more than six months.

This gave him the idea to start Mu Sigma that could use the abundant analytical skills available in India. He started Mu Sigma by selling his Illinois home and putting in $200,000 from his savings.

Mu Sigma then developed an in-house training program called MuSigma University to train freshers in Bangalore in specialist skills across financial services, retail and consumer products, pharmaceuticals, technology, and telecom industries.

Mu Sigma signed on Microsoft as its first customer in 2005, and today the company offers its products to more than 200 Fortune 500 organizations in the areas of marketing, risk, and supply chain across 10 industry verticals.

Its client list includes Wal-Mart, Dell, and Pfizer Inc. The majority of its 4,000 employees are based out of its headquarters in Bangalore, India, and it has a main delivery center for the US in Chicago. It also has offices in UK and Australia.

Mu Sigma was among the pioneers to offer outsourced high-end data analytics. But, unlike other India-based outsourcers, Mu Sigma does not rely on the low-hanging fruits of labor arbitrage. Instead, it is extremely process-driven and has developed a platform that provides solutions that encompass the process of Data Engineering, Data Sciences, and Decision Sciences.

Mu Sigma defines Data Engineering as the stage of data acquisition, storage, processing, and workflow management; Data Sciences as the stage of applying advanced algorithms; and Decision Sciences as the stage where it provides complex, real-time decision support analytics.

Mu Sigma competes with outsourcing giants such as Cognizant, Tata Consultancy Services, Infosys, and Wipro as well as startups such as New Jersey-based Opera Solutions, LatentView Analytics, and Fractal Analytics.

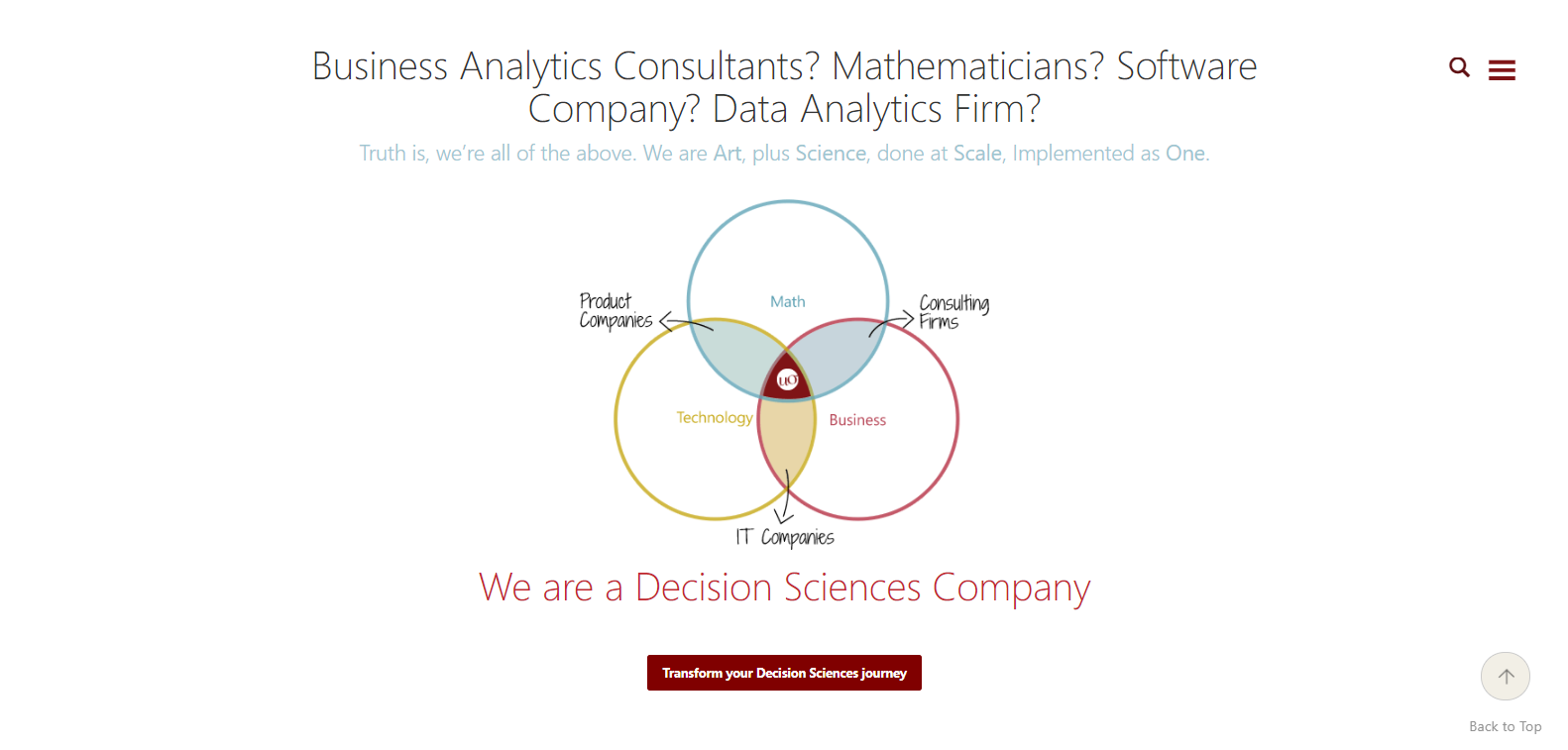

Marketing Strategy – Mu Sigma markets themselves as a company which combines the expertise of a Business Analytics Consultants along with a Software Company as well as a Data Analytics Firm. They say that they’re all of the above.

They are a company which has Art, plus Science, done at Scale, Implemented as One big firm. They combine the expertise of product companies with IT companies along with consulting firms to make Mu Sigma and give fortune 500 companies better results than any other company in the market.

User Base & Valuation – Since Mu Sigma is a B2B business, it doesn’t have normal consumers as its user base. Instead it serves big fortune 500 corporations. It’s estimated that the company serves more than 200 fortune 500 companies.

In February 2013, Mu Sigma received an investment of $45 million from MasterCard, which placed the company over the $1 billion valuation milestone. Today the company is valued more than $1.5 billion.

Funding – Mu Sigma has raised a total of $211.4 million in funding over 7 rounds. Their latest funding was raised on Mar 10, 2016 from a Venture – Series Unknown round. Mu Sigma is funded a total of by 4 investors. Their investors are as follows:-

- MasterCard

- General Atlantic

- FTV Capital

- Sequoia Capital India

Revenues – Mu Sigma have estimated annual revenue of $150 million. The company reported $165 million in revenue for the year ended December 2016, down from $184 million in 2015, according to the documents.

In an interview, Rajaram, confirmed that Mu Sigma’s revenue declined last year but said the company was on track to exceeding $180 million in revenue in 2017.

Acquisitions – Mu Sigma has acquired only one startup named Webfluenz on Jul 1, 2014.

Controversies – In early 2016, the company was sued by Aon Corp founder Pat Ryan, who discussed that Mu Sigma lowballed its own growth prospects in order to buy back Ryan’s stake in the company.

In October 2016 Dhiraj Rajaram took over the role of CEO from his estranged wife, Ambiga Subramanian, who was currently serving as CEO at the time. The couple split in 2016, post which Dhiraj became the CEO.

The company’s performance was down during this period of conflict but later the revenues were back to the previous level. Mu Sigma was also involved in a visa fraud where it agreed to pay $2.5 million (Rs 18 crore) as settlement for an alleged visa fraud, after it was investigated by multiple US authorities.

The Bengaluru-based analytics company, which is valued at about $1.5 billion, is said to have been illegally circumventing H-1B visa regulations by actively employing B1 visitor visa holders under contract within the US. The company’s invitation letters for the B1 visa holders are said to have misrepresented the nature of the B1 visitors’ intended business.

The ICE statement said the investigation identified about 400 potential B1 visa violators, and more than 300 instances of illegal visa bond contracts. Investigating special agents also identified nine Mu Sigma executives and managers who actively participated in these schemes, it said.

Present Time & Future Goals – As of now, Mu Sigma is going strong as a company and based upon their strong performance and rebound after a short conflict, they’ll be planning for an IPO in the future.

Conclusion – To sum it up, all we would like to say is that a company which was founded after investing just $200,000 savings has grown to be one of the biggest companies which provide analytical solutions to various fortune 500 companies and it truly deserves nothing but a bright and better future for itself.

We hope them all the very best for their future and hope that they’ll be launching an IPO in the near future. If you liked this content, then stay tuned to StartupTrak and keep coming back for more content.