SoftBank has just sold their Uber shares worth $2 billion. An affiliate of SoftBank’s Vision Fund sold 38 million shares for $53.46 apiece, according to a US stock filing on Uber’s website, though it still remains the firm’s main shareholder, with a 10% stake worth about $10 billion. SoftBank still holds about 184.2 million shares, according to the filing.

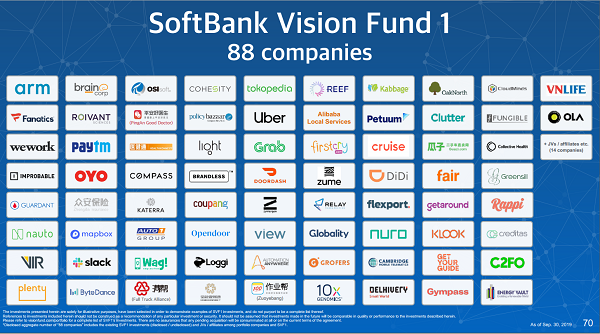

The Japanese conglomerate SoftBank has invested heavily in ride-hailing platforms worldwide in recent years, from California-based Uber to Didi Chuxing in China, Singapore’s Grab and India’s Ola.

It’s decision to buy heavily into Uber appeared to have backfired when its price plunged following a disappointing 2019 initial public offering, before being slammed by the impact of coronavirus lockdowns devastated demand for hired transport. By the end of March, Uber’s share price had fallen below $15, from $42 on its first day of trading in May 2019.

But the food-delivery business has surged during the pandemic, making up for much of that loss. Management has suggested delivery could be as big as or bigger than ride-hailing once the pandemic passes. Uber has pledged to turn a quarterly adjusted profit by the end of this year.

SoftBank shares have also rallied as investments like Uber have recovered and several of its portfolio companies have gone public. SoftBank has sold off assets to fund record buybacks of his own stock. Following the selling of shares, SoftBank Group’s shares rose 0.8% to 8,050 yen in Tokyo morning trade.