Khatabook is Digitizing the Financial Transactions of Small Businesses

Introduction – Khatabook is the fintech startup that provides a digital ledger app targeted primarily at small businesses to maintain all their financial transactions as well as to collect payments on time.

It was founded by Ravish Naresh in 2018 and is headquartered in Bengaluru, Karnataka, India. It’s India’s fastest growing SaaS Company that enables micro, small and medium businesses to increase efficiency and reduce costs through safe and secure business and financial solutions.

The industry has noticed its contribution to changing India’s business landscape, and the startup was conferred the “Best Innovative Mobile App” 2020 award at the India Digital Awards in February 2020.

Early Days – KhataBook was started in 2016 when Ravish, who is also co-founder of real estate search portal Housing.com and AI-powered SMS Inbox Kyte, came across developer Vaibhav Kalpe’s business accounting app.

Vaibhav had built the app after seeing his father face challenges in recording his electrical shop’s receivables. Naresh acqui-hired Vaibhav and his team, and launched KhataBook, aiming to become the first business accounting software that India’s merchants used.

At Khatabook, they’re building utility solutions for the nation’s 6.3 crore-strong MSME sector. Their first offering – an Android App enables businesses to digitally record the credit they extend to customers – went viral and so far Khatabook has been downloaded over 4 Crore+ times.

As more businesses are adopting digital for business than ever before, Khatabook’s goal can be summed up simply – Empowering merchants by simplifying their business. MSMEs play a crucial role in the Indian economy.

Khatabook gives this ecosystem the digital tools they need to support their businesses, empowering micro, small and medium enterprises at a critical time – as the country undergoes a major digital transformation amidst COVID-19.

Using a digital-first approach while keeping the needs of the merchants of Bharat at the centre of product design, has helped Khatabook reach 4 Crore registered merchants across 12 languages in less than a year. With this momentum, Khatabook is poised to become a strong distribution platform for other services and products tailored to India’s merchants.

Khatabook provides a lot of features to their clients such as:-

- Automatic Data Backup

- Generate Transaction Reports

- 24*7 Multi Lingual Support

- Zero Payment on QR Transactions

Marketing Strategy – Khatabook have roped in Indian cricketer Mahendra Singh Dhoni as their official brand ambassador. He frequently appears in their ads which promote the use of their mobile app to collect payments and also to maintain a record of all the financial transactions.

User Base & Valuation – Khatabook has a user base of more than 4 crore registered businesses. The platform has its presence in 700 of the country’s 729 districts – a huge feat for a startup that is just a few years old. The startup is now valued at more than $300 million.

Funding – Khatabook has raised a total of $111.5 million in funding over 4 rounds. Their latest funding was raised on May 20, 2020 from a Series B round. It is funded by a total of 29 investors. Some of their investors are as follows:-

- B Capital Group

- Surge

- Alexander Will

- RTP Global

- EMVC

- Unilever Ventures

- Falcon Edge Capital

- DST Global

- Kunal Bahl

- Rohit Bansal

- Mahendra Singh Dhoni

Revenues – According to Khatabook’s filings, the company has lost a total of Rs 126 crore in FY20 up 85.7X from the losses of Rs 1.47 crore in FY19. The startup is still in loss and is yet to make a profit. The startup is still in loss because they are trying to expand quickly and aggressively to capture the market as soon as possible before their competitors such as OkCredit.

Acquisitions – Khatabook has acquired just 1 startup. They have acquired Biz Analyst on Mar 25, 2021. They acquired Biz Analyst for $10 million.

Controversies – Khatabook has been involved in a major controversy. It’s been alleged that the startup has launched an app that was merely the copy of another app.

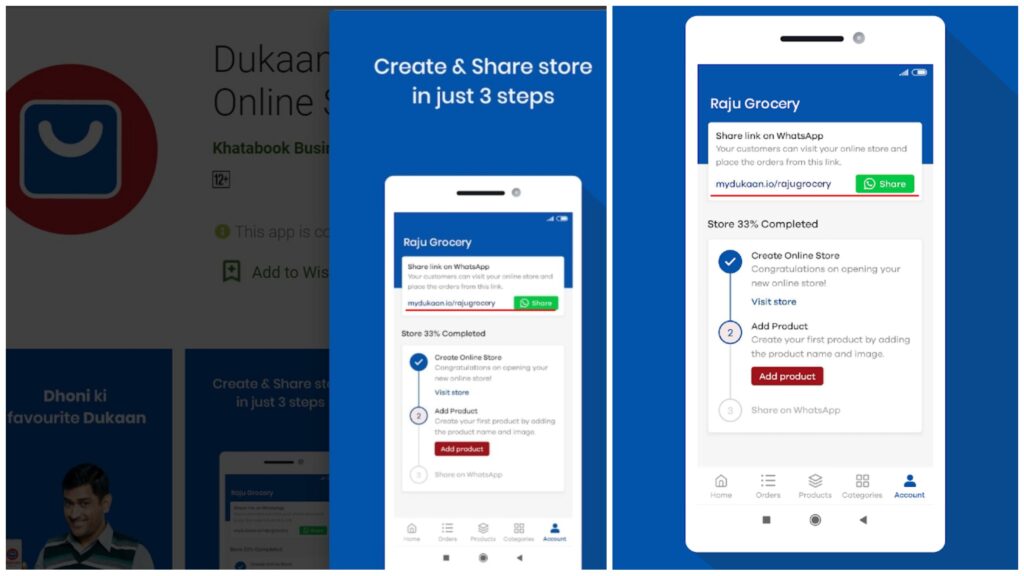

Khatabook launched its Dukaan app, which has come out to be a replica of another app called Dukaan launched 2 months back. This has created a controversy and Dukaan filed a legal complaint against Khatabook for subsisting and continuing violation of trademark and copyright.

But, Khatabook’s has denied all these allegations. After Khatabook launched an app named Dukaan on the Google play store, people were quick to notice the striking similarities between the 2 apps with the same name, layout, themes, features and services.

After 2 months of controversies and blame game, Khatabook & Growthpond (MyDukaan.io) has finally ended with both the companies mutually settling their legal dispute concerning the Dukaan app. Khatabook will acquire nominal equity in Growthpond’s Dukaan as a part of the settlement process whereas Growthpond will now be allowed to list its Dukaan app on the playstore.

Khatabook and Growthpond, in a joint statement, said, “We think that storefront apps are a very relevant solution for small businesses in India to continue doing business in the world with pandemic reality.

With this matter now firmly behind us, Khatabook will focus on driving the adoption of the shopfront app, MyStore, by Khatabook. Growthpond will get Dukaan re-listed and focus on the app’s continued progress.”

Present Time & Future Plans – Khatabook future plans are to raise another $100 million from investors to continue their business operations. Their vision is to onboard as many small businesses as possible on their tech based platform so that small businesses can also compete with big MNCs.

Its co-founder and CEO said “Small Businesses have 30% contribution to the GDP of India and they form the backbone of the Indian economy. We aim to digitize and automate all the flows happening in their shops with software.

Our vision is to create a singular dashboard where small and medium enterprises can see their entire business picture.” He also added “Moving forward, we plan to augment our service portfolio and drive two- to three-fold growth in business by providing more relevant solutions and value to our users.

Remaining committed to India’s MSME segment, we will be adding services to streamline and simplify business processes for the merchants”.

Conclusion – To sum it up, Khatabook is a strong contender in the fintech industry but it’s not alone. Although they have witnessed a massive boom in their business operations but so have other fintech startups as well.

Their closest competitor OkCredit might be their biggest rival and if they lose in any corner, they might lose. The future of the fintech industry is quite bright and startups working in this sector will never have a slowdown, all thanks to the lockdown due to the pandemic which forced the entire world to go digital.

As of now, they have everything that’s going to make them even stronger in the future. But what’s your opinion? Do tell us in the comments. We appreciate your comments and we will reply to the ones we find interesting and valuable.

If you liked this content, then stay tuned to StartupTrak and keep coming back for more content.