What is Navi Finserv?

The financial services startup Navi Finserv founded by Flipkart co-founder Sachin Bansal. Navi was launched in the year 2018 in Bangalore, Karnataka. The Navi software is a loan-lending application. Navi is a middle-income lending app that offers instant and contactless personal loans.

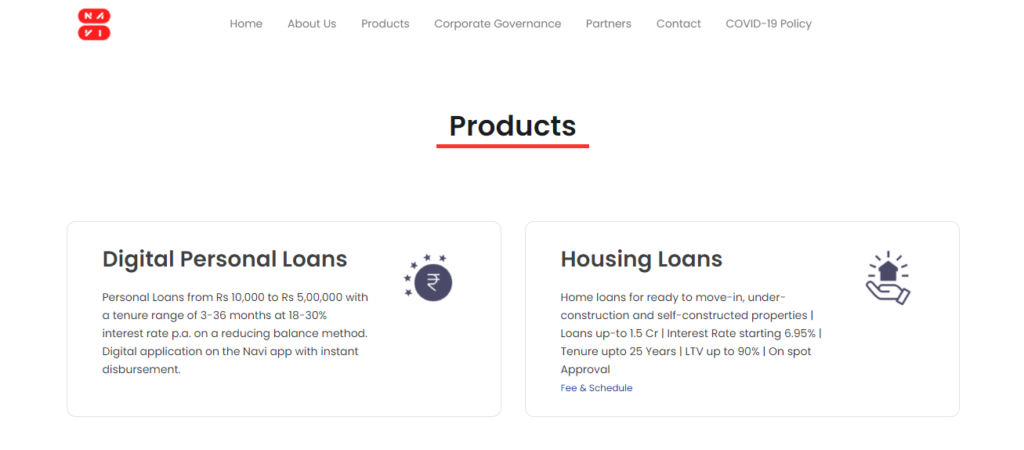

Through a digital and contactless operation, loans up to Rs 5 lakh for 36 months can be received. It currently serves 150 cities across India, and the NBFC reports that the beta process in April received a positive response from Tier 1, 2, and 3 towns, prompting the official launch.

The procedure is completely paperless, and no records such as pay stubs or bank accounts are required to be uploaded. Loans from the Navi app are allocated in less than 10 minutes for most borrowers, and in as few as 5 minutes for some.

You must be an Indian citizen to take out a loan from the Navi app. You must be at least 18 years old. A borrower’s credit score is extremely important. You must also pick the city name where the app is allowed to be used to determine eligibility.

Navi Finserv Growth

Sachin Bansal led a fund infusion of approximately Rs 3,000 crore into Navi in March 2020, which included Rs 253 crore in cash and shares worth Rs 2,675 crore. Another filing by the Bengaluru-based firm in April 2020 disclosed that Gaja Capital had spent Rs 204 crore, resulting in the transfer of 1.45 crore shares.

Other high-net-worth individuals have made investments in Navi. Navi has raised a total funding of $402 Million till now. With its investors like Gaja Capital it’s valuation is upto524 Million. Navi has seen a growth of 86% since 2018 and it is increasing rapidly.

Features of Navi Finserv App

- A credit of up to Rs 5 lakhs is available to customers.

- Fund transfer in a flash- Money transfer to a bank account in a flash.

- The entire procedure is conducted entirely digitally or without the use of paper.

- You can choose your EMIs and loan amount whenever you want.

- You should confirm your eligibility right away.

- There is no need for a security deposit.

- You can get an instant home loan of up to Rs 1.5 crore using the Navi app.

- There is no documentation available before you receive a loan request; after you receive an offer, fewer documents are required.

- The Navi app offers a large loan balance for a longer repayment period.

- For a term of up to 25 years, it’s simple to pay off your EMIs.

- Under-construction, self-constructed, and ready-to-move-in houses are also eligible for loans.

- There are no application, legal, valuation, or paper processing fees to pay.

App-based lenders obtain consumer details from trading and brokerage accounts, as well as credit and debit card transactions directly from banks, in order to test loan applications and avoid fraudulent transactions.

In addition, the Reserve Bank of India-approved credit bureaus are used to obtain a customer’s work records and credit background.

Hassle-Free Retail Home Loans

Navi Finserv of Navi Technologies has announced a plan, through the Navi application in Hyderabad, to start its quick, hassle-free and affordable retail house loans in the weeks ahead.

Navi will include household loans from INR 10 LaKh to INR 1.5 Crores, which are for employees and self-employed professionals, which will hold up to 25 years’ tenure and a 6.95 per cent interest rate. Navi Finserv is a Non-Banking Finance Company registered with RBI (NBFC).

Customers who qualify can make use of loans of up to 90% of the real estate value. Customers can install the Google Play Store Navi App, click the “Home Loan” button, complete a paperless trip to verify eligibility, obtain the home loan deal immediately.

Authorization is fully digital and paperless, providing consumers with an easy choice for home credit that is clear and fast. Loans may be used to purchase homes for ready-to-occupy, renovation or self-built homes.

Navi home loan was introduced in Karnataka in December 2020, and Hyderabad is the first city to which it is spreading since its conception. Navi will be serving Greater Hyderabad with Hyderabad town, Ranga Reddy and Medak.

Other chosen cities in India will also be available between May and September 2021. From May 2020, Hyderabad and Telangana already have Navi’s digital personal loan service via the Navi App, with huge consumers’ reaction from launch.

Types of loan Granted by Navi Finserv

- Wedding loan

- Debt consolidation loan

- Top-up loans

- Home renovation loan

- Medical loan

- Travel loan

How to Apply for Loan?

- Click here to get the Play Store Navi Application

- You need to click the “Apply” tab when you have the application.

- To complete your loan application, you must fill out essential facts such as Full Name

- Your Age

- Your Martial status

- Enter Residency Pin code

- You must then fill in the data about work and income:

- And insert your PAN number lastly

- Your loan is then processed promptly to examine your credit score and other facts at the rear end

- And in 10 minutes your loan would be completed

Navi Finserv is an instant loan lending app so will you try to take loan from the app as it is easy to obtain. Navi Finserv is a solution for emergency loans. Do comment below, what are your thoughts about Navi Finserv?

If you liked this content, then stay tuned to StartupTrak and keep coming back for more content.