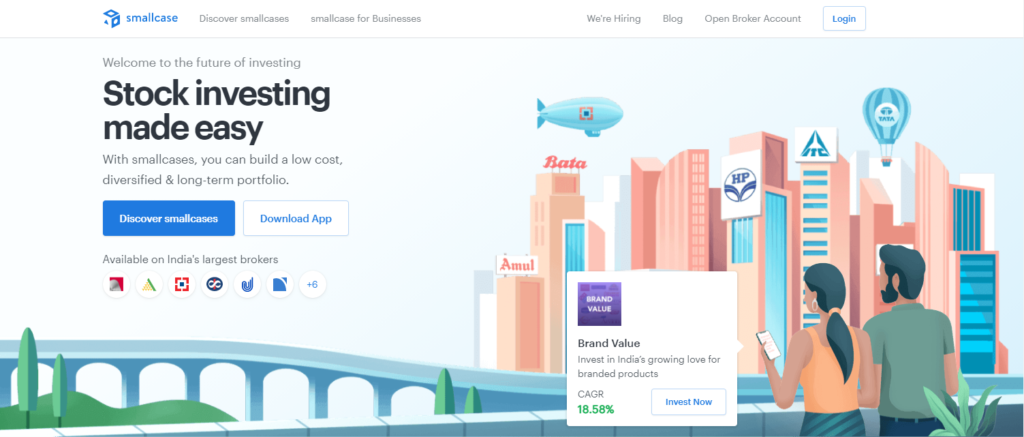

Smallcase Technologies, headquartered in Bengaluru, is setting the stage for modern investors by enabling them to choose from professionally customized stock buckets that represent an investment concept or plan.

Smallcase, which was co-founded by IIT Kharagpur alumni Rohan Gupta, Anugrah Shrivastava, and Vasanth Kamath in 2015, specializes in offering equity and financial advisory products to financial market investors through portals like Zerodha, HDFC Securities, Kotak Securities, 5Paisa, and AxisDirect.

Smallcase has a good amount of valuable investors like Sequoia, Blume, Beenext, WEH Ventures and Straddle Capitals. The company has more than 12 broker partners with a team of 100+ team of finance professionals, engineers & designers with diverse backgrounds & skills.

What is Smallcase?

Smallcase is a collection of stocks that represent a certain investment trend, concept, or industry. An earningsin it may be made up of high-yielding securities, while an IT smallcase might be made up of leading tech companies.

It now has scores of pre-built portfolios and investment strategies developed by SEBI-licensed experts such as brokers and research analysts, who screened and weighted constituents using mathematical models and algorithms.

All major brokerages, including Zerodha, HDFC Securities, Kotak Securities, Axis Direct, Edelweiss, and Angel Broking, have collaborated with Smallcase, which offers an infrastructure to the developers of these portfolios.

A Demat account is required to invest in smallcase. The stocks/ETFs used in it will be credited or debited to your wallet when you buy or sell it. Based on the stocks that make up a smallcase, the required minimum sum can vary.

Once you’ve decided on a smallcase, you can spend a lump sum or set up a structured savings plan for it. There are standard trading fees to be charged. In addition, a one-time processing fee will be charged and 18% GST is applicable.

How Smallcase works?

- Go to the smallcase website or app and log in. To log in, you must use the credentials issued by your broker. You will not be able to use the services if you use a broker other than the ones mentioned above.

- Once you’ve signed in, you can select from a variety of themes, including all-weather, smart beta, and deal buys.

- You’ll now be able to see the stocks that make up the portfolio, their proportions, and why they were chosen. The small case can be customised by inserting or deleting stocks.

- Once you’ve made your smallcase pick, you’ll be guided to the payment portal. The minimum value you would pay for the smallcase is determined by the price and weight of selected securities.

- After payment is received, the broker site will place buy requests on all stocks, which will be executed as soon as possible based on liquidity.

- If illiquidity causes a few orders to go unfulfilled, the investor will be able to repair their order at a later time, after which a new order will be placed. To guarantee that the portfolio matches the initial theme, it must be repaired.

Mutual Fund Vs Smallcase

- Investing in mutual funds incurs fees such as portfolio administration, dealer commissions, and other costs. This cost ratio is deducted annually from the mutual fund contribution and approximately equals 1-1.5 per cent of the investment.

- Smallcases on the other hand ,applies Brokerage Fees: 0 (if you don’t purchase or sell on the same day).

- Once a smallcase is chosen, you can invest a lumpsum or choose to run a systematic investment in it. Standard brokerage charges are applicable.

- If mutual fund investments result in fund units, smallcase investments result in shares in your Demat portfolio.

- It allows you to trade in innovations rather than market capitalization-based stocks. If the government’s priority is to provide affordable accommodation to all, for example, one can invest in businesses that are working on affordable housing programmes. There is no equity fund that can have such publicity.

- An equity mutual fund’s redemption offer typically takes three working days to process. During trading hours, an investor can monitor transactions in full detail with smallcase. Since appropriate liquidity is among the stock-picking metrics used in smallcases, redemption requests are also made in real-time. As a result, redemptions are possible quicker.

There are 270 ‘smallcases’ in total, including All Weather Investing, The Great Indian Middle Class, Safe Haven, Electric Mobility, and Bargain Buys, among others. Market Leaders, IT Majors, Consumerism, Banking Magnates, Hamara Bajaj, and All Weather ETFs are among the six themes offered by Fyers, that introduced thematic investments in 2017 and reconfigured it in 2019.

Beginner’s Basket, Health and Wellness, India’s Wealth Compounders, Dividend Champions, and main objective StockBaskets such as Domestic Education Basket, International Education Basket, Retire in 2040, and International Vacation Basket, among others, are one of Samco Securities’ 28 ‘StockBaskets.’

Is it safe to Invest in Smallcase?

These themes are groundbreaking in nature and aid in the creation of a thematic portfolio. When a registered investment advisor creates a ‘smallcase’ for his clients or a professional investor consciously participates in designing and rebalancing his own style, it helps with execution.

New owners, on the other hand, can take it with a grain of salt. Smallcase orders can be customised to eliminate “unnecessary” buy and sell orders and reduce processing costs. Also, these aren’t meant to be a substitute for mutual funds; rather, they’re a way to create a wider portfolio of stocks focused around a certain theme by taking direct equities exposure.

You’ll also be able to invest in diversified themes or diversify the portfolio by investing in a variety of themes. If you’re a seasoned businessman, you should check it out by putting a portion of your money into it.

If you’re new to equity investing and have a high-risk tolerance, see it as a long-term learning opportunity and begin with a small investment.Since you’re already buying stocks, price risk exists. However, since you’re purchasing a portfolio of stocks, you won’t be exposed to individual stock risk.

As a result, it is better than buying individual stocks in this manner. Hence, it is safe to invest in smallcase. It should be remembered that the smallcase platform may not be ideal for a first-time or new investor, since he or she may lack the necessary qualifications to comprehend the product’s risks. Before investing in this asset, you can speak with a financial planner.

Comment your opinion about smallcase. If yes, then would you like to invest in smallcase? If you liked this content, then stay tuned to StartupTrak and keep coming back for more content.